Good News - the Inflation Reduction Act

Congress Passes the Inflation Reduction Act

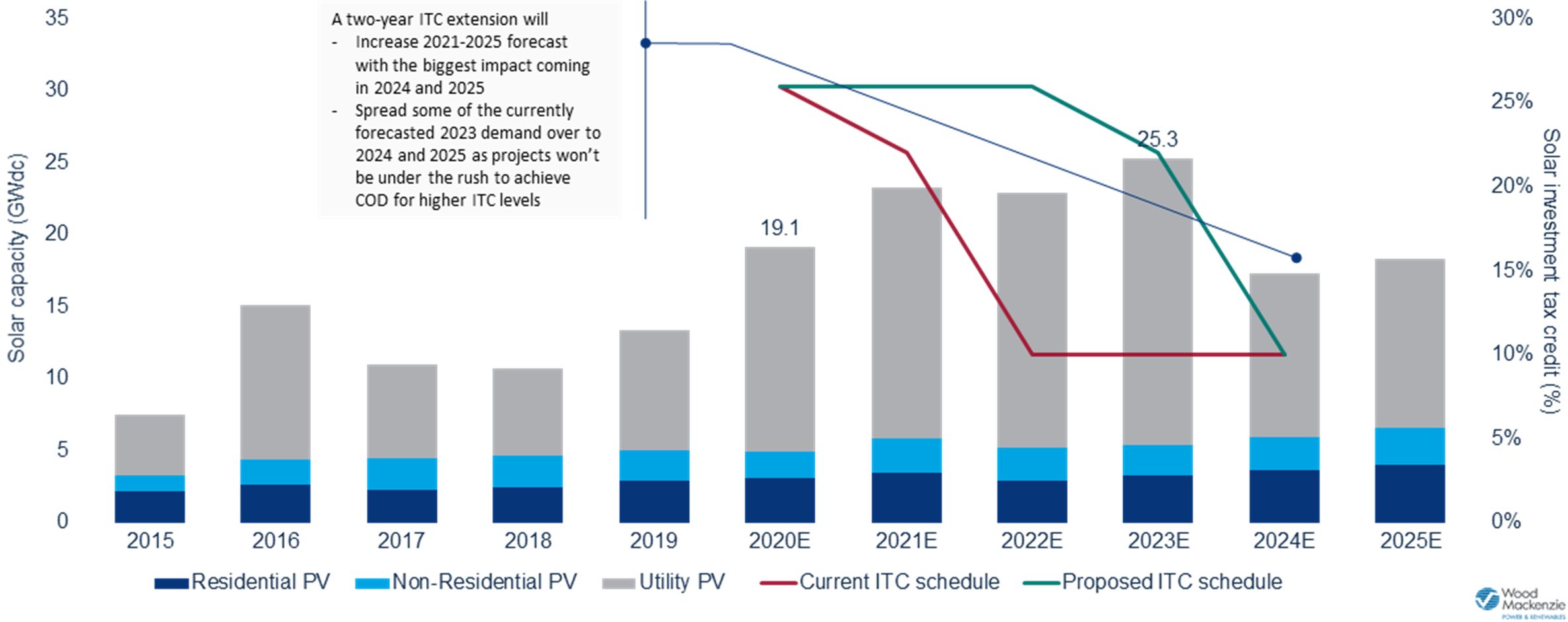

Solar tax credit impacts

30 percent credit for projects that begin construction through the end of 2032.

Many of the large-scale solar development set to be completed through 2032 have used "safe-harbor" provisions to secure the original 30 percent ITC credit, removing the risk of seeing project financing disrupted by a reduction in the tax credits, Manghani noted.

But a two-year extension is “a much better outcome than the industry had expected,” Manghani said. It will provide significant upside to solar growth in 2022 through 2032, as more projects can secure the 30 percent and 26 percent credits through "commence-construction" or "safe-harboring" provisions by 2032.

What’s more, the bill “provides the industry a full extra year to negotiate longer-term tax credits or tie renewables directly with future carbon policies with the friendly Biden administration,” Manghani noted. Utility-scale solar power is already cost-competitive against coal-fired power across the world and with natural-gas-fired power in many markets.

The lack of a direct-pay provision "may be a bit disappointing for the smaller solar developer shops that have had a tough time securing tax equity capital in the pandemic-induced [economic contraction],” Manghani conceded. But, he added, “all in all, the industry will reflect on this outcome as a glass three-quarters full.”

This includes Velux Skylights with a Solar powered blind, Velux Sun Tunnels with a Solar powered night light as well as all our redilight Solar powered LED products. Click here to find out how to apply the credits.

Solar Tax Credits Extended